Verification

Students are randomly selected by the United States Department of Education to provide additional documentation to the institution to double check and confirm the information provided by the student on the Free Application for Federal Student Aid (FAFSA).

The institution has the authority to request all necessary documentation to complete the verification process. Documents can include a verification worksheet, copies of Federal Tax Return Transcripts from the student, the student's spouse and/or parents, SNAP benefits certification, child support paid certification and/or an identity and statement of educational benefits.

Students selected for verification are contacted via email by ProEd, a vendor that assists UTEP with verification processes. Students are then required to upload and submit the requested verification documents into the ProEd student portal, and are permitted to submit verification documents no later than two weeks before the end of the student’s payment period. If the student fails to submit the requested verification documents, the student will not receive any financial assistance.

After submitting all required verification documentation, if applicable, necessary corrections will be made and submitted to the U.S. Department of Education’s Central Processing System on the student's behalf by the Office of Student Financial Aid (OSFA). Once the corrected FAFSA has been received (usually within 3 business days), verification is complete and the student's financial aid award will be packaged or re-packaged. Any changes to a student's award package as a result of an increase or decrease in Estimated Family Contribution (EFC) due to verification will be communicated to the student via an emailed updated Award Notification.

If information discrepancies lead the OSFA to suspect fraud, an investigation of the matter is conducted by appropriate UTEP staff members and the suspected applicant’s case may be referred to the U.S. Department of Education’s Office of Inspector General (OIG) to determine if the applicant engaged in fraud or other criminal misconduct.

A step-by-step guide

- Go to goldmine.utep.edu

- Log in with your UTEP username and password

- Click on "My Eligibility"

- Click on "Student Requirements"

- Complete/submit all unsatisfied requirements

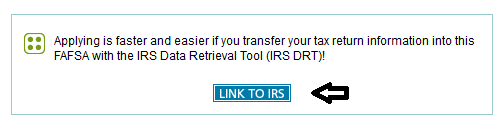

The IRS Data Retrieval Tool transfers your IRS tax information directly into your FAFSA. To use the Data Retrieval Tool, complete the following steps:

- Go to fafsa.ed.gov and select the “Start Here” button

- Log in using your FSA ID

- Select the “Continue” or “Make a Correction” button

- Select the "Financial Information" tab from the top of the page.

- Answer the questions in the first box to see if you are eligible to use the IRS Data Retrieval Tool

- If eligible, click “Link to IRS”

- For parent: Provide FSA ID for parent providing IRS information

- For parent: Provide FSA ID for parent providing IRS information

- Proceed to the Sign and Submit page

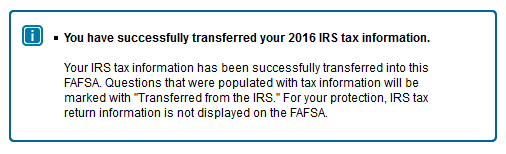

For your privacy, the tax information you transfer from the IRS into your FAFSA form won’t be visible to you. Instead, you will see “Transferred from the IRS” in the appropriate fields on fafsa.gov, the IRS DRT web page, and on the Student Aid Report.

If you and your spouse/parent(s) cannot use the IRS Data Retrieval Tool please request a Federal Tax Return Transcript by using one of the following methods (Please call (844)545-5640 to schedule an appointment prior to showing up at the local IRS offce):

- In person at 700 East San Antonio Street (in El Paso) or the local IRS office in the city or county the taxpayer resides in.

- By telephone at (800) 829-1040.

- Through their website IRS.gov

Changes in Your Financial Situation

Often time, families have a change in their financial situation since the date the FAFSA was originally submitted. These financial changes might qualify you for an income adjustment/reduction. Changes in financial situation(s) can include:

- Employment

- Divorce or Separation

- Death, Disability

- Other

If the student and/or their parent(s)/spouse have experienced a change in family income and a FAFSA has been submitted, then the student should speak to a Financial Aid Advisor (FAA).

A FAA will provide recommendations on steps to take. If you submit a FAFSA after the last available financial aid workshop you must wait until we receive your FAFSA information to speak to a FAA about an income adjustment/reduction.

Verification of Selective Service

If you are a male between the ages of 18-26, you are required to register for Selective Service through the U.S. Post Office or the Selective Service website at www.sss.gov.

Failure to register for selective service will prevent the student from getting a financial aid award offer. Male students who were unable to register prior to their 26th birthday must visit the Office of Student Financial Aid to resolve this matter.

UTEP Federal School Code: 003661