Hazlewood Policies

**TEXAS HAZLEWOOD ACT IS NOT RETROACTIVE TO PRIOR SEMESTERS**

Multiple DD-214s

On each form the Home fo Record or Place of Entry must be Texas. The Discharge must be either Honorable or General Under Honorable Conditions. Training days do not count towards the required 181 active duty days.

Non-Degree Seeking

Students must be degree seeking regardless of Hazlewood category. Exceptions:

- Leveling or Pre-Requisite courses required for acceptance into a program at UTEP

SAP Requirements

Students must meet the GPA and attempted hour policy of the university

| Academic Level | Maximum Hours/Time | GPA Requirement |

|---|---|---|

|

Graduate |

Not to exceed 150% of the required hours on Degree Plan |

3.0 |

|

Undergraduate (UG) |

Not to exceed 150% of the required hours on Degree Plan |

2.0 |

Please see the financial aid office for the SAP Policy

Option 2 of the SAP policy (Completion Rate/Pace-minimum 67%) is not recognized when determining eligibility for Hazlewood. SAP (satisfactory academic progress) must be reviewed for last semester attended. Students have the option to complete a "good" semester on their own and are encouraged to inquire with the Office of Student Financial Aid regarding an appeal.

Course retake

- Legacy students can retake courses if the course is a requirement on the degree plan regardless of the final grade received in the course.

- Veteran, Child, or Spouse students may retake courses since they do not require a degree plan

Tuition Specific, Financial Aid and/or Other Awards

Tax Transcript

An updated copy must be submitted yearly from the current or previous tax year

PROGRAMS EXCLUDED FROM HAZLEWOOD ACT

Hazlewood exemption cannot be used for executive education and certain certificate programs for the reason that the school does not receive state formula funding (tax support) for these programs (ex. Exective MBA, Alt Certification Program (ACP). If you have questions about your specific program you are enrolled in, please contact our department so that we may assist you.

"Enroll in classes for which the college receives tax support (i.e., a course that does not depend solely on student tuition and fees to cover its cost), unless the college's governing board has ruled to let Veterans receive the benefit while taking non-funded courses"

https://www.tvc.texas.gov/education/hazlewood-act/

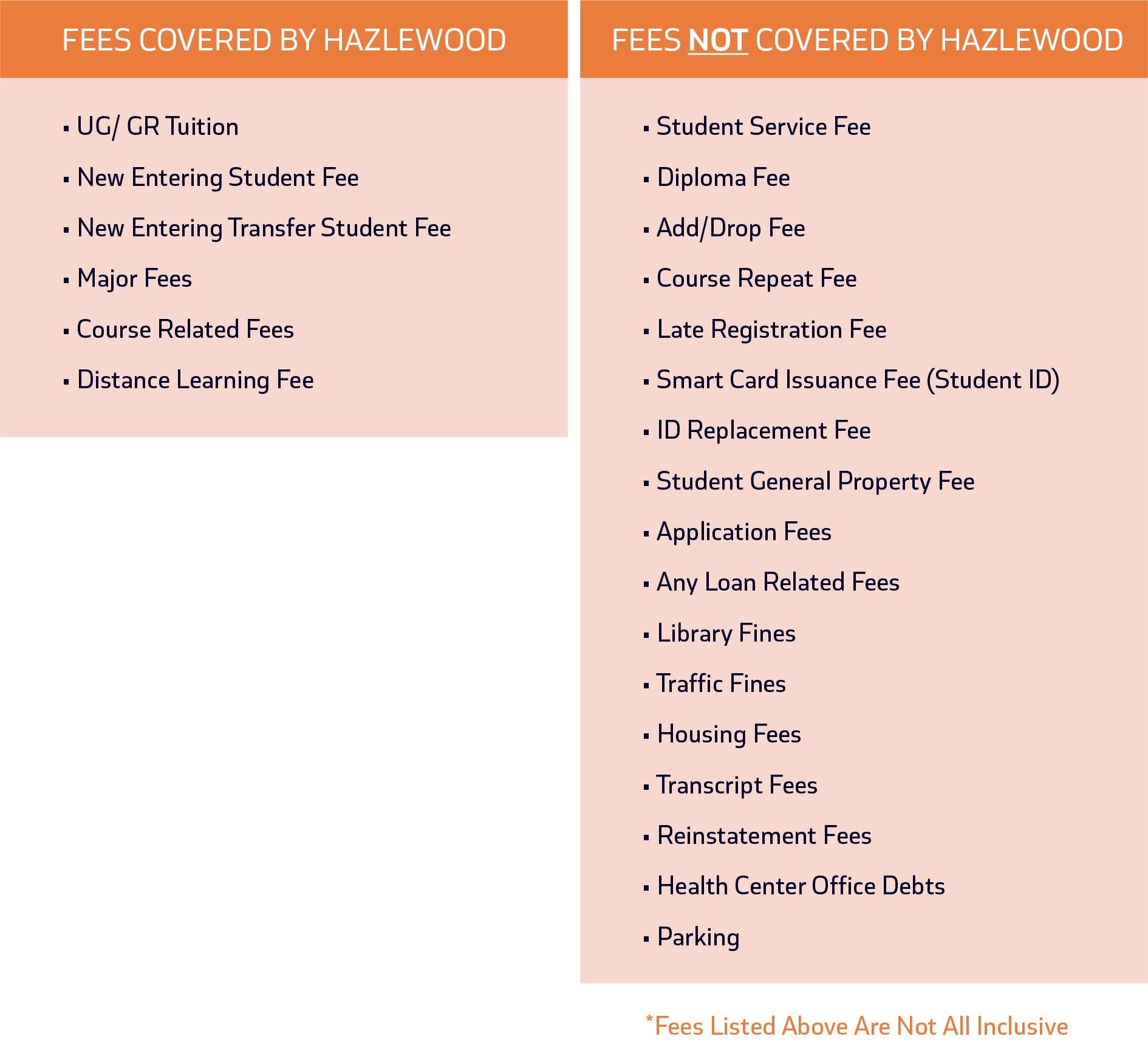

Fees Covered/Not Covered